Budgeting can really feel like rather a lot at first. And on prime of all of it, there are so many alternative ways to price range. How do you choose?

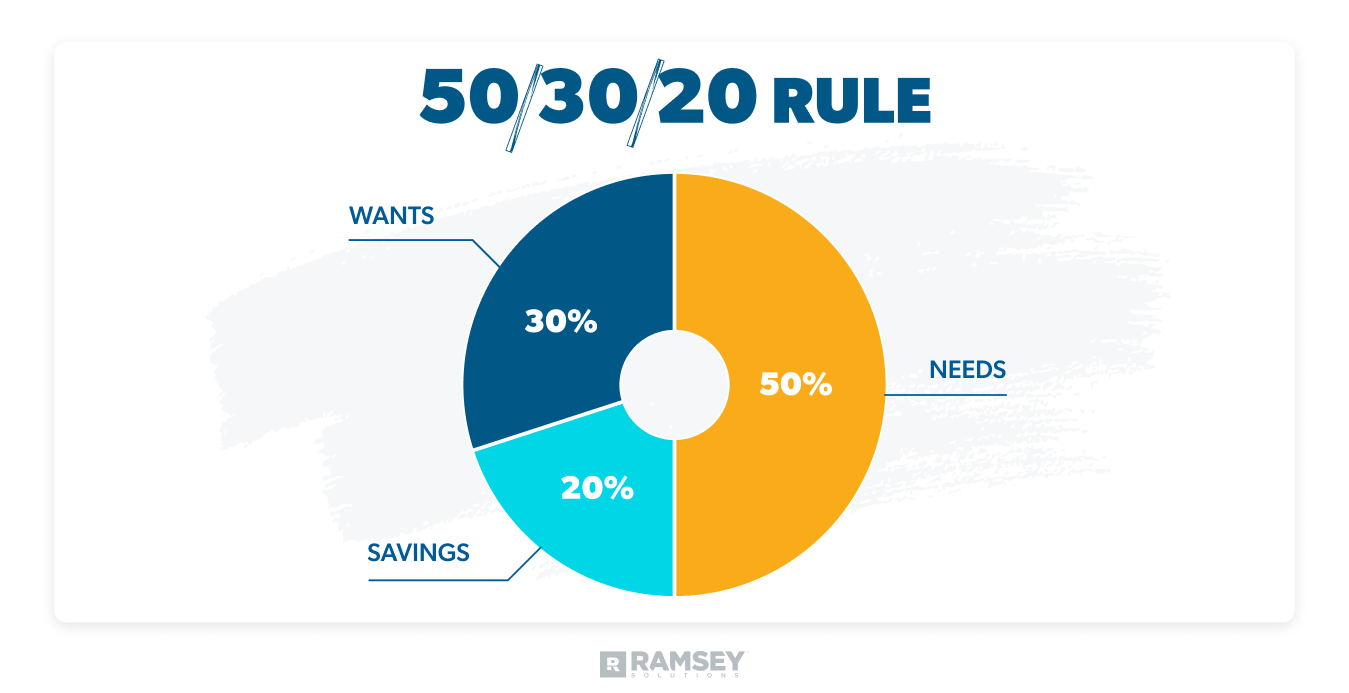

Let’s dive into one widespread technique on the market: the 50/30/20 rule. We’ll speak about what it means and the way it works—and see if it’s the easiest way to price range for you.

What Is the 50/30/20 Rule?

What’s the 50/30/20 rule? Effectively, this budgeting plan first confirmed up in 2005 in a guide referred to as All Your Value. It was initially named the 50/20/30 rule—however you’ll see it referred to as the 50/30/20 rule extra typically.

This budgeting technique divides your spending and saving into three classes: wants (50%), desires (30%) and financial savings (20%).

50% Wants

Wants in your price range are all of the issues that might majorly have an effect on your life in the event you dropped them. Listed here are some examples:

- Meals

- Utilities (like electrical energy, water, pure fuel)

- Shelter (aka mortgage or hire)

- Transportation

- Medical health insurance

- Day care

- The minimal funds on all of your money owed

If these issues are in your price range, you want to pay for them—so that they fall into this part.

30% Desires

You guys, learn this fastidiously: Desires aren’t wants.

And everyone knows this—in idea. However after we begin dividing issues into month-to-month price range classes based mostly on desires versus wants, the strains can get actual fuzzy.

Desires nonetheless have an effect on our lives, however not like wants. We will do with out desires (even when it’s uncomfortable).

The 50/30/20 rule says to spend 30% of your take-home pay on the stuff that improves your lifestyle. This consists of issues like:

- Limitless information plans

- Eating places

- New garments (not as a result of your child outgrew his jacket however since you fell in love with a cute new jacket)

- Sporting occasions

- Live performance tickets

- Streaming providers

Hmm . . . so 30% of your earnings can go to the belongings you need, even in the event you’re drowning in debt or have an empty financial savings account? One thing’s off right here.

20% Financial savings

The financial savings class within the 50/30/20 rule covers some tremendous necessary components of your price range:

- Retirement investments

- Emergency fund financial savings

- Any further debt funds above these minimal funds

That’s simply 20% of your earnings to get you feeling protected and safe with cash for at present, tomorrow and down the road in retirement. And also you’re engaged on all three without delay.

Okay, so you’ll be able to most likely inform by now that I’ve some issues with the this rule. Let’s speak about why.

Professionals and Cons of the 50/30/20 Rule

Professionals

First, what’s useful concerning the 50/30/20 rule?

Budgeting is a mandatory behavior.

On the upside, in the event you’re utilizing the this rule to price range, effectively, you’re budgeting! You’re making a plan to your cash, and that’s so necessary.

Beginning factors are useful.

Additionally, the 50/30/20 rule offers you a place to begin that can assist you determine the place your cash goes. Once you make your first price range, utilizing a top level view or pointers may help you are feeling much less overwhelmed. I completely get that.

You’re saving cash.

Our State of Private Finance examine exhibits 34% of Individuals haven’t any financial savings in any respect. So I do recognize that the 50/30/20 rule values constructing that up.

Cons

Prepared to listen to the issues?

It stays the identical.

These three price range percentages keep the identical regardless of the place you might be in life. Whether or not you may have a mountain of scholar mortgage debt otherwise you’re debt-free and investing in retirement, you’re caught with 50/30/20.

Right here’s the deal: You shouldn’t spend 30% of your cash on desires in the event you’re in debt, as a result of debt robs this month’s earnings to pay for final month (or final 12 months, even). Once you’ve acquired debt, you must reduce down on extras so you’ll be able to repay the debt and get your earnings again in your management.

![]()

Begin budgeting with EveryDollar at present!

Additionally, the 50/30/20 rule has you plugging alongside slowly on the similar objectives on a regular basis. You shouldn’t attempt to hit so many main cash objectives without delay!

As an alternative, line up your huge cash objectives (utilizing the 7 Child Steps to information you) and knock them down one after the other. You’ll be capable of actually focus as you save for emergencies, repay debt, and construct your retirement financial savings.

Guess what occurs whenever you use your price range to take these steps one after the other as a substitute of struggling to do it suddenly, on a regular basis? You. Make. Progress. And that’s what I would like for you—to make progress along with your funds!

Your price range ought to dwell and breathe with you. It ought to adapt to your stage of life and to your cash objectives. The 50/30/20 rule simply doesn’t try this!

It’s approach too targeted on desires.

Focusing in your desires retains you from ever getting forward along with your cash. You may need to make sacrifices in your price range proper now, and that’s okay. It’ll all be price it later.

Someday, in the event you observe the 7 Child Steps I simply talked about, you find yourself being so financially safe that you may dwell and provides like nobody else.

Don’t field your self into these three numbers perpetually. Do the exhausting work now so you’ll be able to spend your cash precisely the way you need later.

Budgets aren’t one-size-fits-all. Your price range ought to replicate your actuality. It ought to replicate the place you might be proper now and the place you need to be along with your cash—not be pressured into some blanket proportion class. That’ll imply adjusting how a lot you spend on desires at completely different levels of life.

It actually doesn’t work for the common American.

Right here’s the true kicker: Should you plug in nationwide averages for earnings and bills, the 50/30/20 rule doesn’t work. Common wants are extra than 50% of the common earnings.

Severely. Have a look at this math.

First, Revenue

- $74,580 is the median family annual earnings.1

- $5,017 is roughly a family’s month-to-month take-home pay (after taxes, Social Safety and Medicare come out).2

- Breaking that down with the 50/30/20 rule, you’d have $2,509 to spend on wants.

Subsequent, Bills

Let’s speak about frequent bills that may rely as wants and see if these averages add as much as $2,509.

- Common month-to-month groceries for a pair: $6853

- Common month-to-month housing prices:

- Mortgage/hire: $1,885

- Electrical energy: $129

- Water: $58

- Pure fuel: $37

- Home items: $584

- Common month-to-month transportation prices:

- Gasoline: $179

- Upkeep and repairs: $815

- Common month-to-month medical insurance: $3096

- Common month-to-month bank card debt cost: $116.107

- Common used automotive cost: $5258

Whole common bills: $4,062.10

That’s not 50%. It’s 81%.

Should you’re a median American with debt, you don’t have 30% left for enjoyable or 20% for financial savings. You can’t use the 50/30/20 rule. And in the event you’ve been attempting, you’re most likely annoyed, and also you would possibly be sitting beneath rising bank card debt as you attempt to sustain with percentages that don’t work to your present life.

Once you put the 50/30/20 rule to the take a look at, effectively . . . that math doesn’t add up! Actually.

By the best way, if this seems to be something like your scenario, I do know these numbers are uncomfortable. Please know: You aren’t caught right here. It’ll take some work, however you’ll be able to improve your earnings, repay that debt, and get far more room within the price range.

However you’ll want a unique sort of budgeting technique.

The 50/30/20 Rule vs. the Zero-Based mostly Funds

What you want is a zero-based price range. What’s that?

A zero-based price range occurs when all of your earnings minus all of your bills equals zero. You give each greenback a job and take management of each penny!

Once you’re itemizing out your bills, you begin with giving and your wants. (What I name the 4 Partitions go first—meals, utilities, shelter and transportation—after which different necessities come subsequent.) After that, you prioritize the whole lot else within the price range based mostly on your earnings, your scenario and your Child Step.

As issues change in your life, you modify up the place your cash’s going!

And also you do all this inside your versatile zero-based price range (which will get all of your cash working for you) as a substitute of inside a no-budge 50/30/20 rule.

However first, you want a zero-based budgeting instrument. And I occur to have one to advocate: EveryDollar. That is the budgeting app my household makes use of, and you may get began at present. For. Free!

No 50/30/20 for you—no attempting to cram your life and your objectives into percentages that severely don’t work. Go all in with the zero-based technique and create a price range that’s actually made for you.